From one year to the next, CRA lending targets may come easy or hard. Sunsign offers an innovative, systematic program that, in select markets, allows banks to meet their community development CRA lending requirements year in and year out by leveraging a bank’s existing commercial loan portfolio.

Through the Sunsign Program, banks can build their environmental brand image with clear community accomplishments while offering additional, financially-impactful value to current customers at no cost to the bank or customer.

PACE (Property Assessed Clean Energy) lending, when offered through the Sunsign Program, allows banks to capture the CRA benefits without offering PACE loans directly to customers (if the bank prefers not to provide this type of structure) but still participate in the deal.

- Why are banks uniquely well positioned to serve their customers with the Sunsign PACE Program?

-

- Pre-existing lending relationship and familiarity with real estate assets

- Property owners seeking PACE loans must obtain approval from property lien holder

- Who else is now offering your bank customers PACE loan/project opportunities?

- Third-party PACE lenders (from in state and out of state)

- Commercial contractors (with PACE lender partnerships)

- A compelling new offering for existing (and new) customers

- Almost universal pent-up demand for property equipment modernization (i.e., deferred maintenance)

- Retain customers or gain new ones who need additional project capital

- Create project financing and lending opportunities beyond initial loan

- If your bank does not offer PACE lending to your customer, some other financier will…

- And they may substitute out your bank as the property lender if you try and block the financing

How does the Sunsign Program for Banks work?

1.

Sunsign and its energy engineering partner work with the bank’s commercial real estate lending managers to make bank customers aware of no or low-cost energy efficiency study programs available to develop PACE project packages.

2.

Sunsign’s energy engineering partner performs site studies and develops the engineering and economics behind the infrastructure upgrade projects for customer properties.

3.

If the customer so elects, Sunsign works with its social impact lending and energy engineering partners to develop a PACE loan package for up to 20% of the underlying property value

4.

Once approved by the lender, customer, and PACE authority, Sunsign’s social impact lending partner offers the bank an opportunity to participate in the PACE loan package thereby creating a CRA lending opportunity for the bank

5.

Once all loans are consummated and the project package implemented, the bank customer’s building is upgraded at no cost to the customer, the bank has satisfied CRA lending obligations to the extent of the bank’s participation in the deal, and all parties have contributed to an (otherwise difficult to achieve) environmental improvement in the community.

Take control of your CRA lending regulatory obligations and build a strong environmental image for your bank.

Sunsign’s Program is Designed to Support Bank Commercial Real Estate Customers

- Deep experience marketing energy/cost savings opportunities to commercial customers

- Market credibility and the ability to articulate the PACE value proposition

Sunsign Owns Project/Loan Coordination and Deal Closing Responsibilities

- Coordination of the agreements between customers, energy engineers, social impact lenders, PACE authorities, and the bank

- Confirmation of the performance of all PACE requirements (e.g., pre/post audits, paperwork, etc.)

- Oversight regarding all loan, PACE, and contractor documentation necessary to complete the deal

Solve CRA Lending Challenges While Building Customer Good Will and Increasing Loan Portfolios

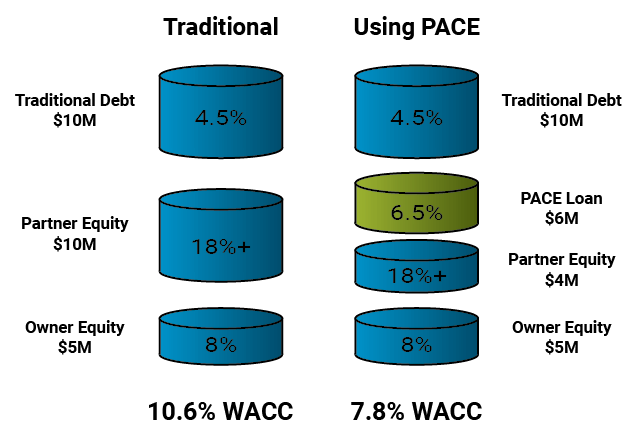

$25 Million Building Upgrade Example

Beyond the reduced cost of renovations, because savings generated through Sunsign PACE projects are immediately greater than the annual loan payments, the bank benefits not only from higher valued property but also a customer with improved operating cash flows.

Contact Us

To determine if you qualify for the Sunsign Program, check out in what states commercial PACE is available, and then click here or fill out the form below and let us know about your building or project under consideration, and we will respond promptly.

© 2023 SUNSIGN SERVICES. ALL RIGHTS RESERVED