What types of commercial sites are good candidates for PACE?

What types of improvements are good fits for PACE?

Why PACE?

Other reasons a commercial property owner or developer would use PACE:

Access to Capital

-

- Underwriting based primarily on underlying property value (i.e., not a traditional business loan)

- No personal guarantees required

Multiple Applications

-

- Address “deferred maintenance” issues as well as efficiency and “wish list” items (e.g., solar)

- Property upgrades no longer limited to LED’s and cosmetic improvements

Return on Investment

-

- Long term, low cost capital (and an equity substitute for developers)

- 100% project financing, requiring no up-front cash investment

- Savings greater than direct investment, generating new cash flows for property owner

Unique Benefits

-

- Transfers upon sale of property (at no cost) as new/improved assets remain with property

- No acceleration of loan upon default

- If property tax assessment is considered an operating expense, then may be considered tax deductible depending on accounting treatment

- Ability to pass on costs/savings to tenants (triple net lease)

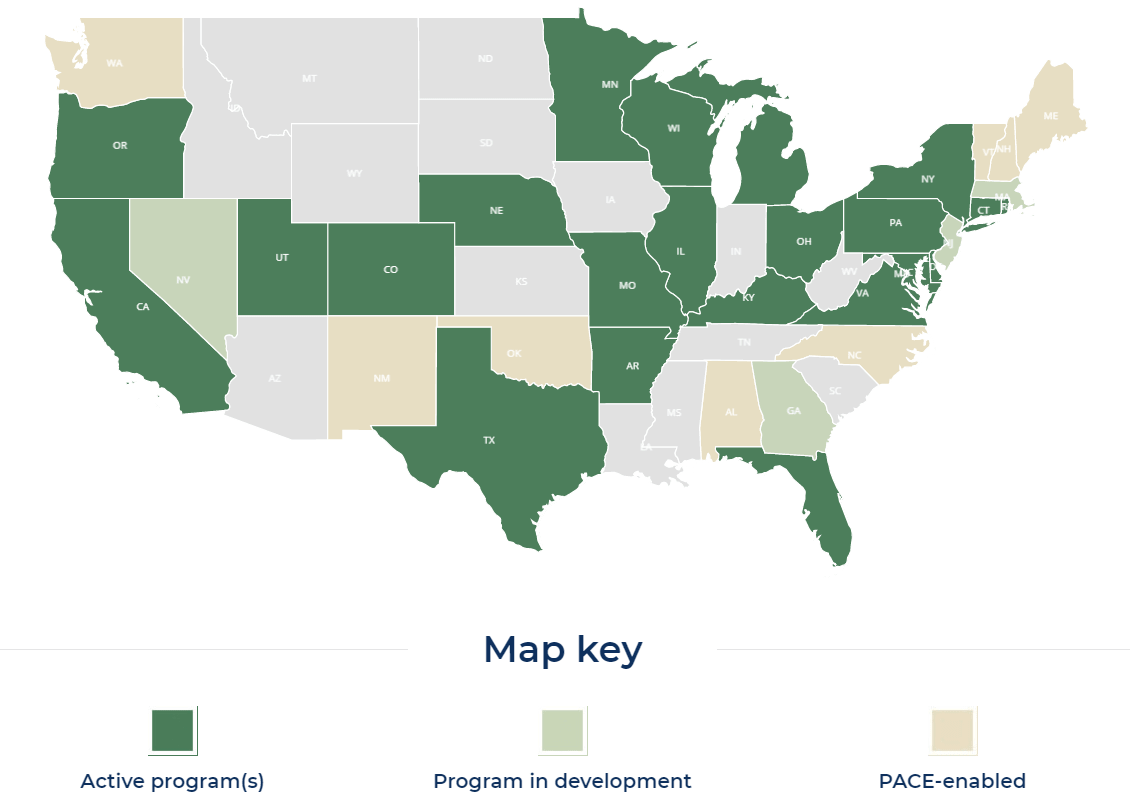

Where can you do commercial PACE?

*Photo sourced from PACENation.us – Updated June 2018

Please visit PACENation.us to see the latest information on programs nationwide.

Contact Us

To determine if you qualify for the Sunsign Program, check out in what states commercial PACE is available, and then click here or fill out the form below and let us know about your building or project under consideration, and we will respond promptly.

© 2023 SUNSIGN SERVICES. ALL RIGHTS RESERVED